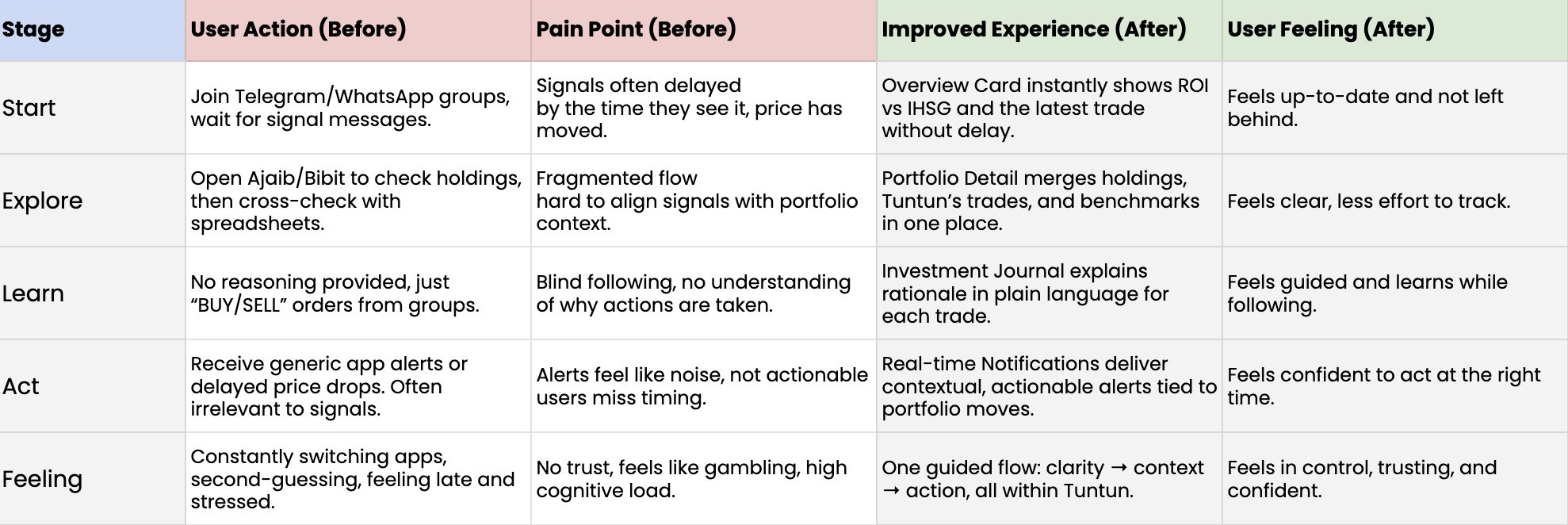

Most retail investors in Indonesia rely heavily on trading signals from groups or influencers. While signals tell them what to buy or sell, users often enter too late, miss exits, or simply follow without truly understanding the reasoning. This creates frustration, lack of trust, and feelings of “gambling” rather than investing.

We saw an opportunity to fix this gap by creating a portfolio experience that doesn’t just show performance, but also delivers timely signals, transparent reasoning, and contextual guidance, helping users act with confidence, not confusion.

To bring this vision to life, I took on multiple roles:

By combining UX design, product thinking, and behavioral finance insights, I aimed to transform a passive portfolio view into an active, trusted decision-making guide.

The real issue wasn’t portfolio tracking. The problem was users following signals without clarity or timing, leading to stress and poor confidence.

"How might we design a portfolio experience that delivers signals with reasoning, context, and actionable timing. so users follow with understanding, not blind trust?"

We defined success not by how many charts or features we built, but by how much clarity, trust, and actionability we could deliver to users. Our portfolio experience would be considered successful if it could achieve these outcomes:

Users can see Tuntun’s trades + reasoning.

Each action explained in plain language.

Notifications arrive on time, relevant, and doable.

To deeply understand investor behavior, we combined qualitative and quantitative research:

This insight reframed our challenge. The issue wasn’t access to data users already had that. The real problem was lack of clarity and guidance around decisions.

“I see my numbers every day, but I don’t know when to buy or sell it feels like guessing.”

Portfolio needs to be more than a tracker it must provide followable guidance.

“I don’t mind following trades, but I need to understand why. Otherwise, it feels like gambling.”

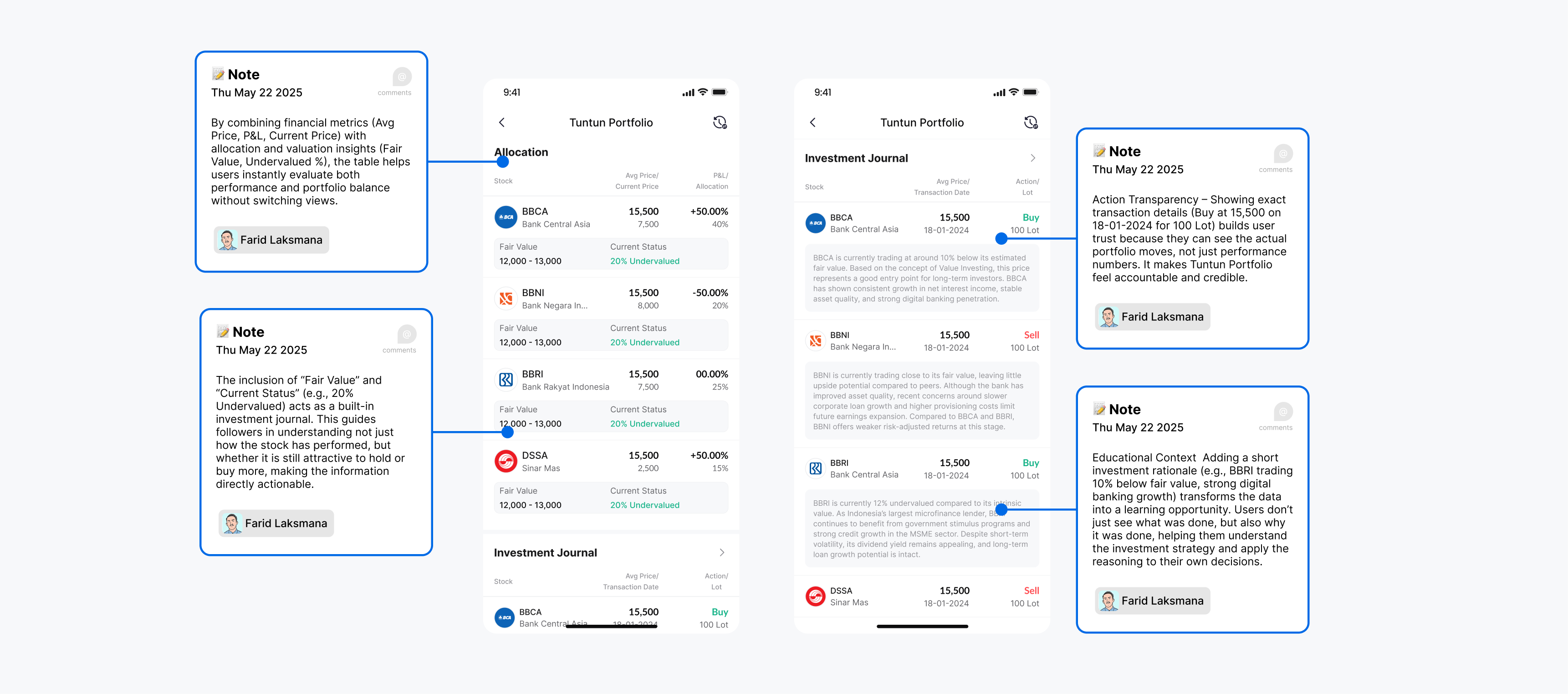

Every buy/sell action must be accompanied by a transparent explanation in the Investment Journal.

“I get notified about price drops I can’t act on it just stresses me out.”

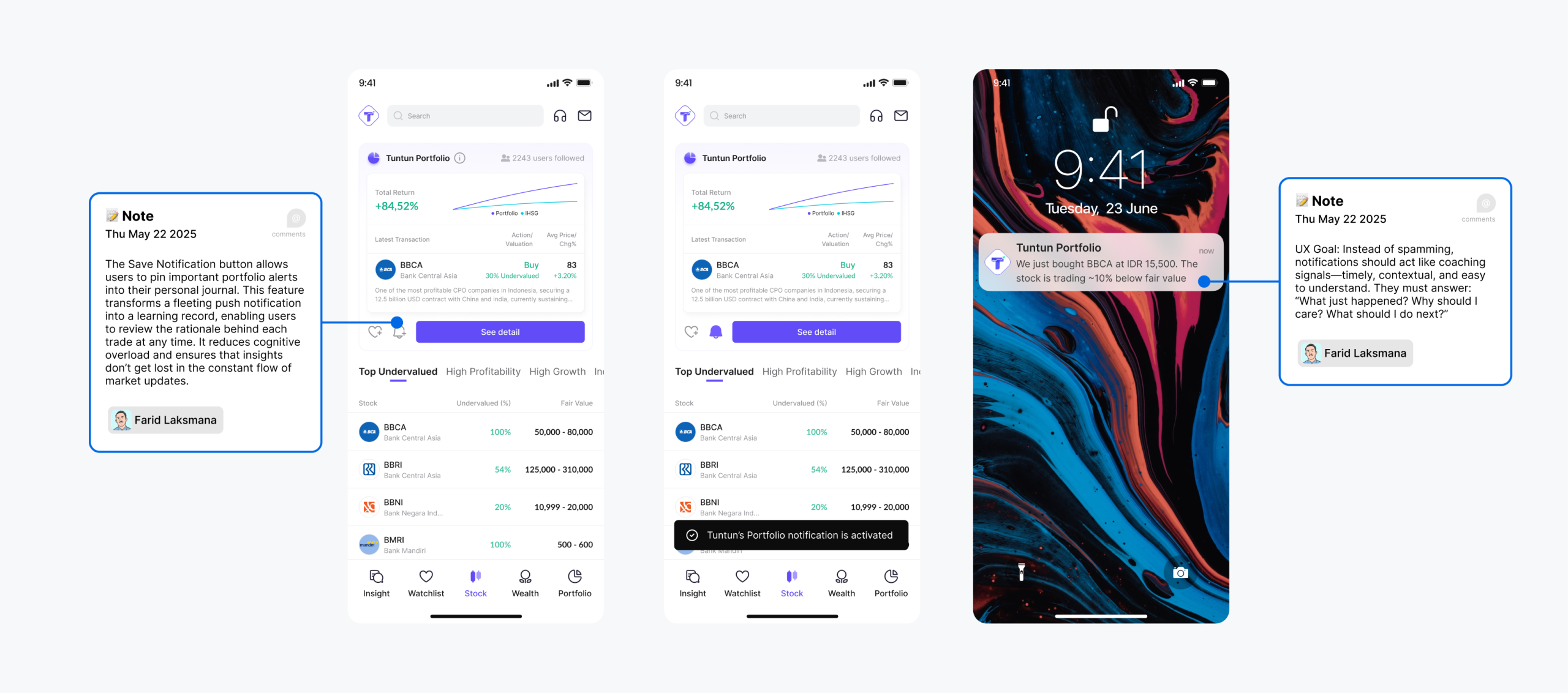

Notifications must be timely, contextual, and actionable, not spam.

From our research, we learned that investors weren’t struggling with access to data, but with how to interpret and act on it. To solve this, we set four UX goals that directly addressed the pain points users had shared.

Clarity is the foundation of any good UX. Users should quickly understand what they’re looking at without extra effort. When information is too complex, users disengage or make mistakes.

Good UX doesn’t just present information, it supports decision-making. Users often need guidance, context, and cues that help them take the right action at the right time.

Transparency builds trust. When users understand why something happens, they feel more in control and are more likely to engage with the product. Hidden logic or unclear changes erode credibility.

Engagement should be meaningful, not manipulative. The goal is to keep users returning because the product genuinely helps them, not because it demands their attention.

We mapped how retail investors currently manage trades: Receiving trading signals from Telegram/WhatsApp. Checking prices and portfolios in separate apps (Ajaib, Bibit, etc). Logging or validating trades in personal spreadsheets. This fragmented flow led to late entries, missed exits, and zero understanding of why actions were taken. This scattered flow revealed the pain points: data silos, lack of transparency, and zero actionable insight.

Each of these ideas aimed to bring users from confusion → guided clarity → confident action.

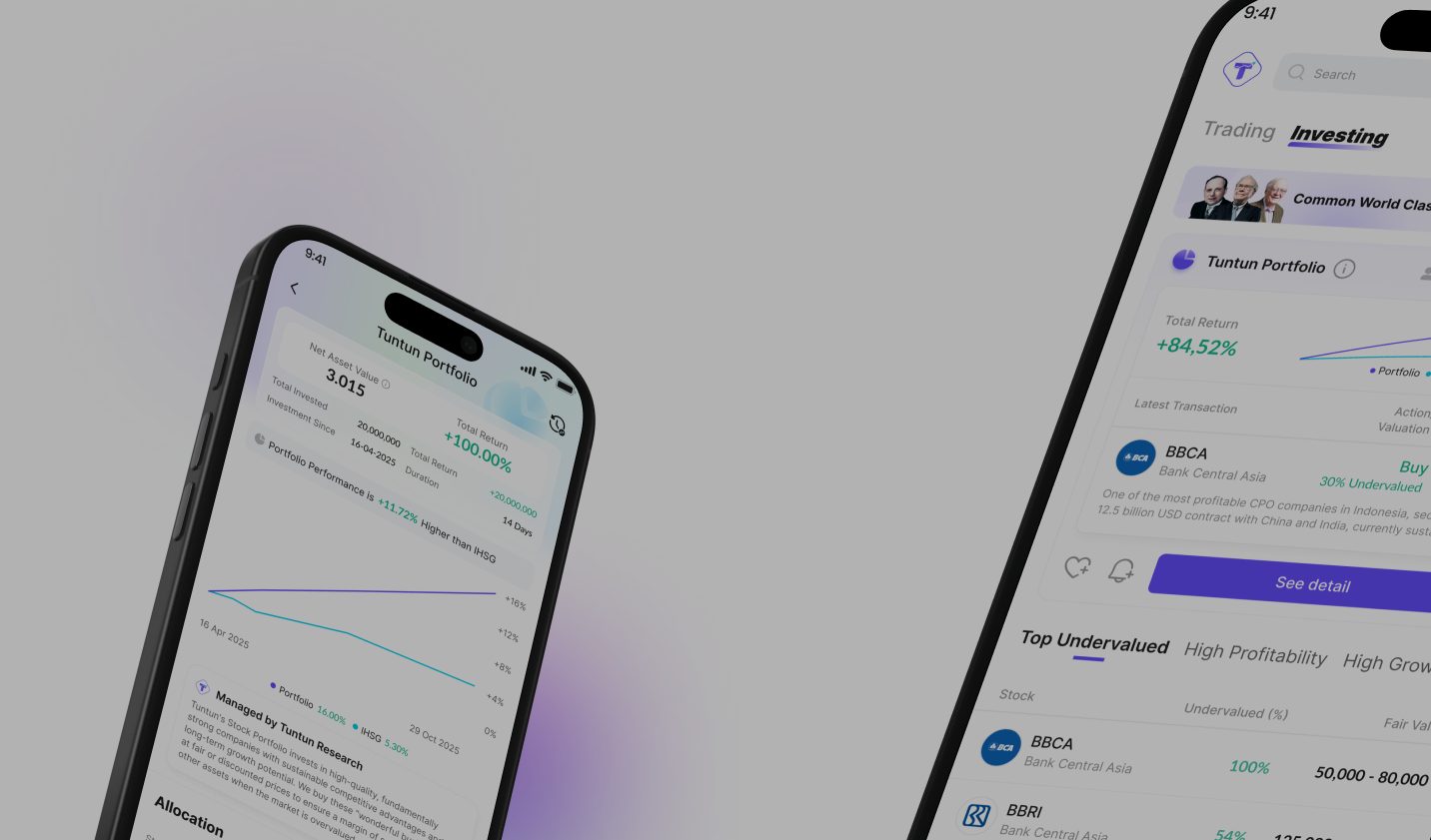

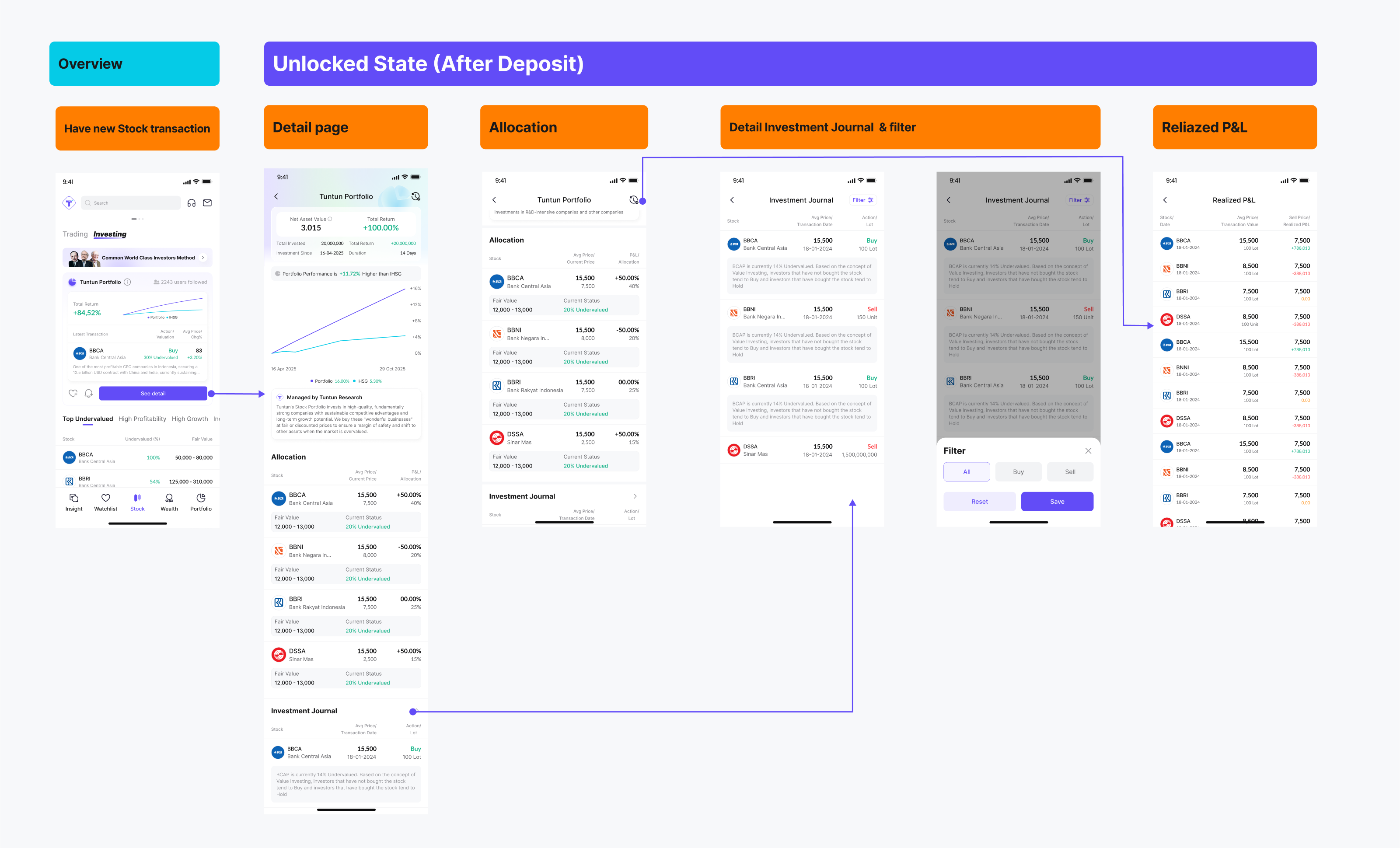

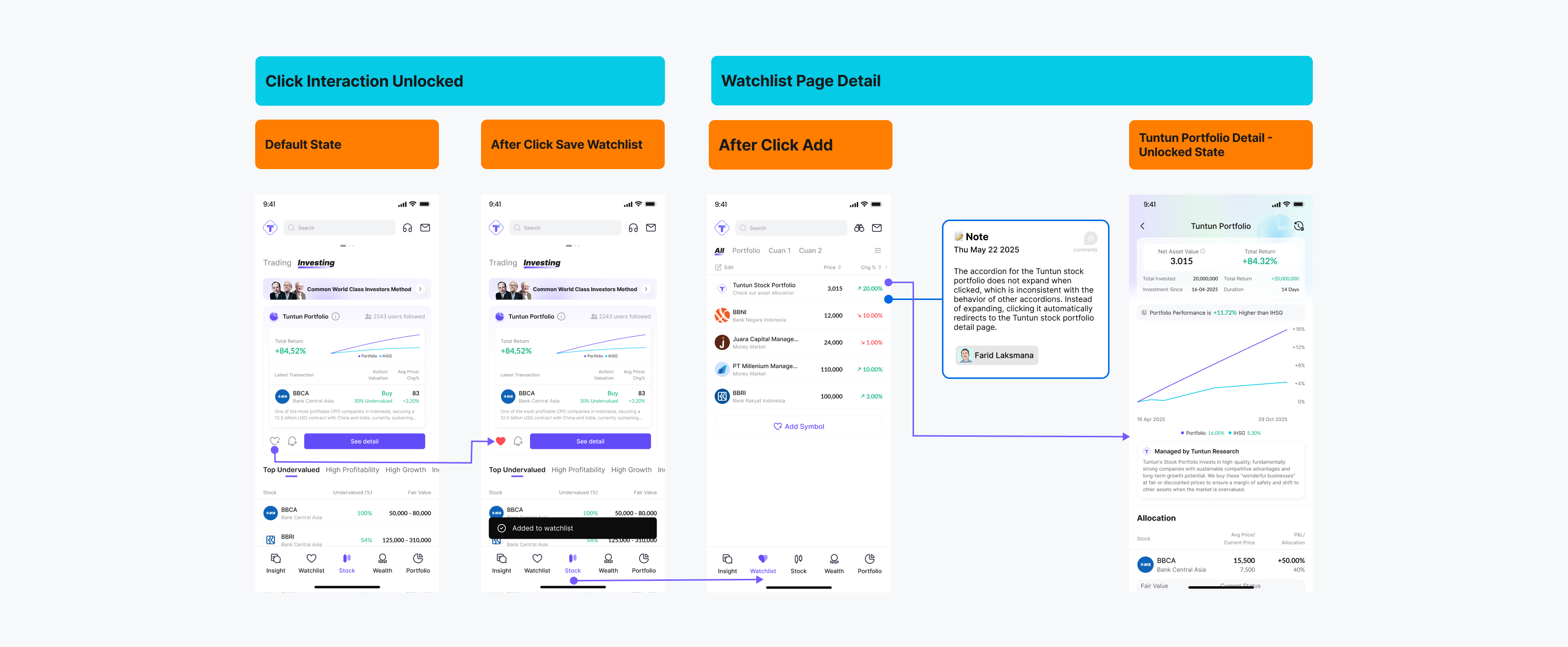

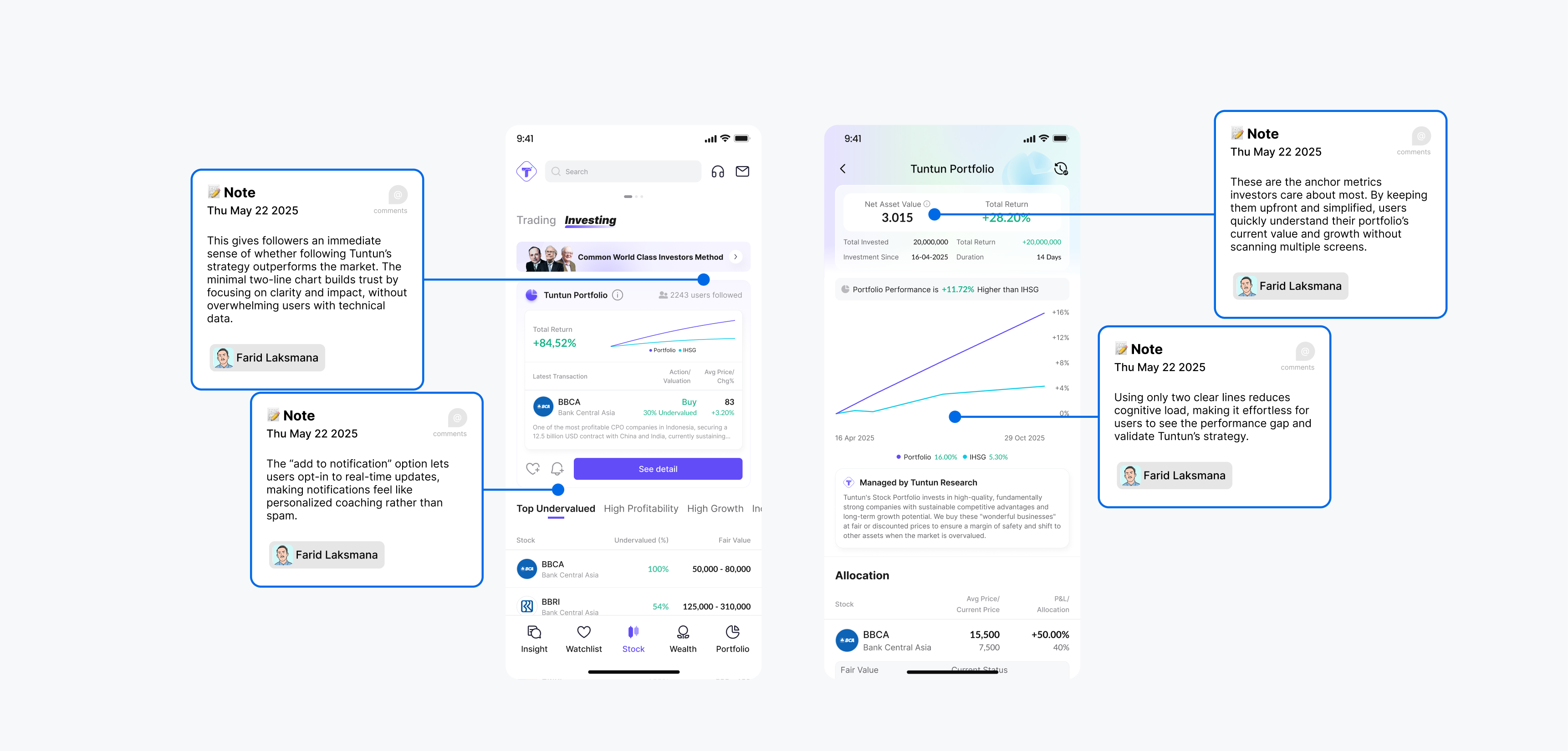

At the homepage, an overview card summarizes the most important metrics ROI, a mini chart of portfolio performance, and the latest transaction. This allows users to instantly gauge how they are doing compared to the market (IHSG) without diving into multiple screens. For users who want more depth, the detail page expands into allocations, price movements, and annotated notes that explain the reasoning behind each trade.

Through this combination, users are empowered to build trust in the product and confidence in their own decision-making process, aligning with the overall UX strategy of reducing cognitive friction while enhancing interpretability.

We introduced a Watchlist feature. Users can now save and organize potential stocks, revisit them later, and easily compare performance in one centralized place. This mirrors real investor behavior and significantly reduces cognitive load, since users no longer need to mentally juggle which stocks they are considering.

As a result, Watchlist transforms passive interest into actionable insight, aligning with the UX strategy of supporting natural investment behavior and guiding users toward better-timed, more confident entry decisions.

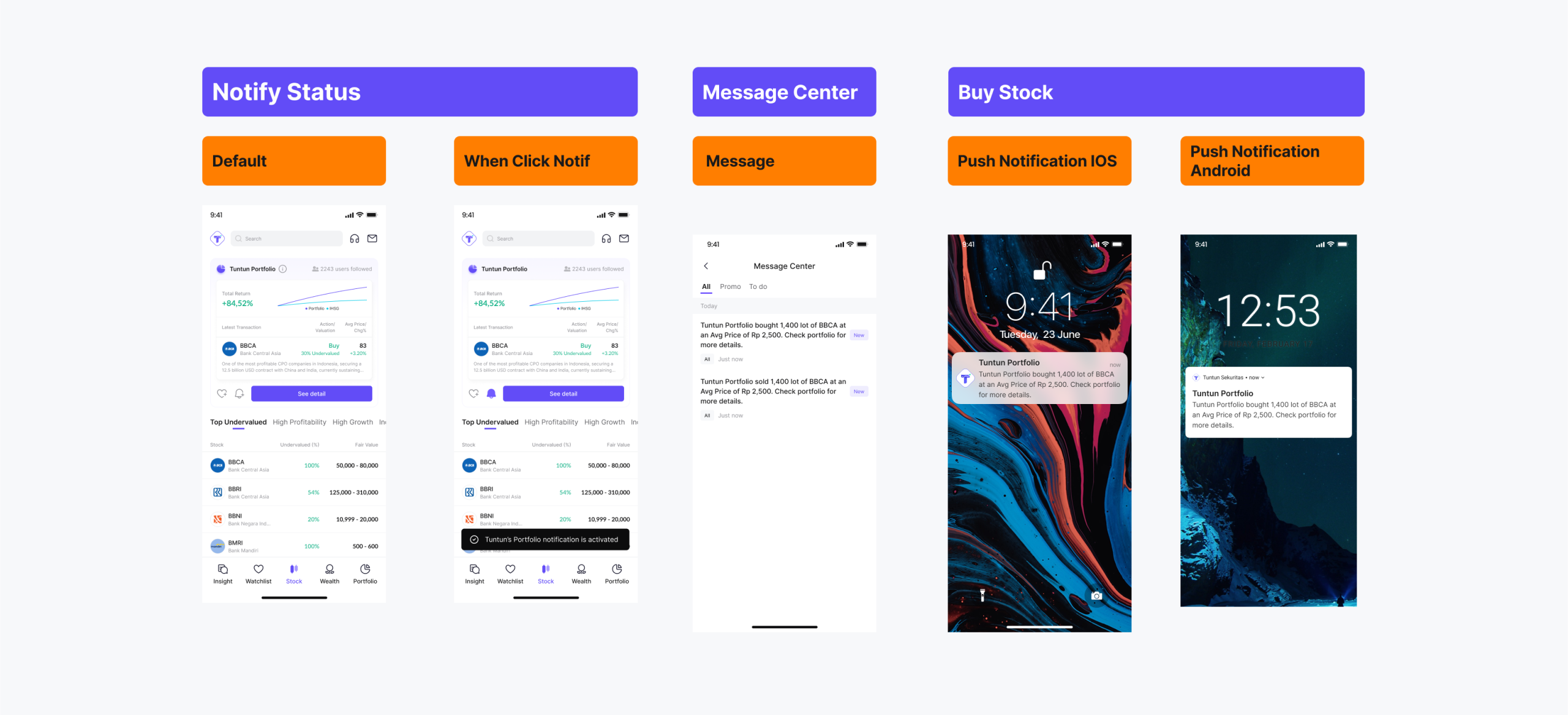

We redesigned the notification system to be event-based, contextual, and actionable. For example, when the portfolio executes a buy or sell, the user immediately receives a short, clear notification with just enough context to act if needed. Instead of constant “market spam,” alerts are now focused on events directly tied to the user’s portfolio or watchlist.

The result is a notification system that guides rather than overwhelms, reframing alerts from a source of stress into a trusted support mechanism. This aligns with our UX strategy of maintaining engagement while reinforcing user trust and confidence in their investment journey.

76% of users felt more confident following trades when explanations were provided. 68% reacted faster thanks to timely notifications compared to Telegram/WhatsApp signals. 72% trusted the portfolio more when performance was benchmarked against IHSG.

We learned that users don’t need more signals or raw data, they need context they can act on. The combination of transparent explanations to be a strong trust builder. Most importantly, when users understood the why behind each trade, they didn’t just follow, they learned, engaged more deeply, and stayed longer.